Owning a small business means tackling new and challenging problems every day. You wake up to tricky situations and scenarios, one of the biggest fears for any small business owner is taxes. When profits are slim, and you have big dreams of better tomorrow, taxes can appear to be a significant deterrent factor. The best way to cover this is to stay two steps ahead and employ effective and efficient Tax Saving Strategies for Small Businesses.

With the right tax planning strategies, you can ease your tax burden while maximising savings. In this article, we’ll look at advice and tactics which help small businesses maximise their tax planning efforts and make sure they make the most of available deductions and credits while staying compliant with tax regulations.

Plan and Time Your Expenses:

When you time your expenses wisely, it can affect how much tax you owe. To minimise tax deductions for small business owners, consider the timing of significant purchases, investments, or expenditures. Delaying expenses to offset anticipated income may be advantageous if you expect higher profits the following year.

On the other hand, bringing forward deductible costs into the current year may help lower taxable income. Expenses deducted from your taxable income and bringing down the income subject to taxation are known as deductible costs. These expenses, which are essential to the operation of your business, are typically incurred during regular business operations.

Record every expense you incur for your business:

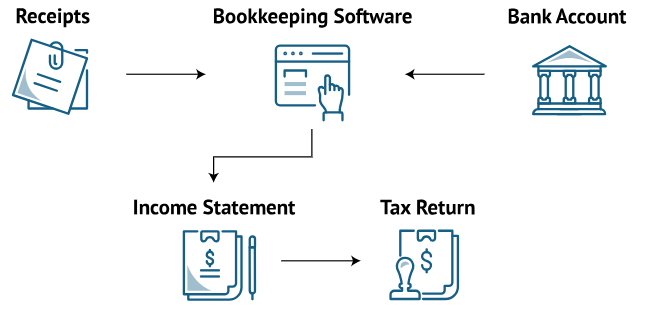

As someone looking for Tax-saving tips for small businesses, you should and must keep track of every expense you incur while operating your business, big or small. You could end up paying more taxes on your profits if you don’t maintain the books correctly.

By keeping track of your expenses, you can better understand your company, how you are spending your money, what areas need your attention next to improve operational metrics, etc. Over time, you’ll have more control over your company and spend less money on taxes. To avoid issues during tax season, separate your personal and business finances. This division makes tax reporting easy and increases your company’s credibility in the eyes of tax authorities.

You must hire professional help to maintain your books which will help you focus on other important business factors. Look no further than Citi Accounts for optimal bookkeeping and minimising taxes for small businesses.

IMAGE CREDITS: Fit Small Business

Use the Available Tax Credits and Deductions:

It is imperative to know within small business tax planning that Small businesses are qualified for multiple tax credits and deductions. Make yourself aware of these potential opportunities for savings, and take advantage of them all. Business-related costs like office rent, utilities, equipment, and marketing expenses are frequent deductions. Look into the tax breaks available for investing in renewable energy, hiring specific employees, or carrying out R&D. These credits and deductions can significantly lower your tax obligation.

The best way to learn about these Credits and deductions is to visit the official government websites, where you can find all the details and conditions necessary for minimising taxes for your small business. Please note that often specific state governments also run such schemes, hence don’t forget to check out those websites as well.

Choose the Right Business Structure:

Choosing the proper business structure is essential for tax planning and can do wonders in reducing Tax deductions for small business owners. Business income is reported on the owner’s tax return in sole proprietorships and partnerships which offer simplicity and pass-through taxation. LLCs allow liability protection and flexible tax treatment, giving owners the option of pass-through taxation or corporation-level taxation. Since corporations are separate legal and tax entities, they may benefit from things like the ability to retain earnings and lower tax rates for qualified dividends. To choose the ideal structure for your startup’s unique requirements, speak with a tax expert.

You can understand more about different types of business structures here.

Involve your Children in Business:

One of the most successful tax-saving tips for small businesses is, Your children probably pay much less in marginal taxes than you do. It will therefore save taxes by transferring business income to them. Give them tasks and responsibilities around your company, and pay your kids a fair wage.

Your child receives a salary from you, but you pay taxes on it at your high marginal tax rate while they pay taxes at your low (often zero) marginal tax rate. This method will work for any low-tax payers you wish to give money to, including your parents in retirement.

Explore Retirement Plans:

Contributions to retirement plans like the Simplified Employee Pension (SEP) IRA or 401(k) not only help you secure your future but offer tax benefits. Schemes are separate for different countries, the NPS(National Pension System) from India and the State Pension System in the UK. Your taxable income decreases by contributions to these plans, which are frequently tax deductible.

To understand better how you can use pension and retirement plans to save tax, read here.

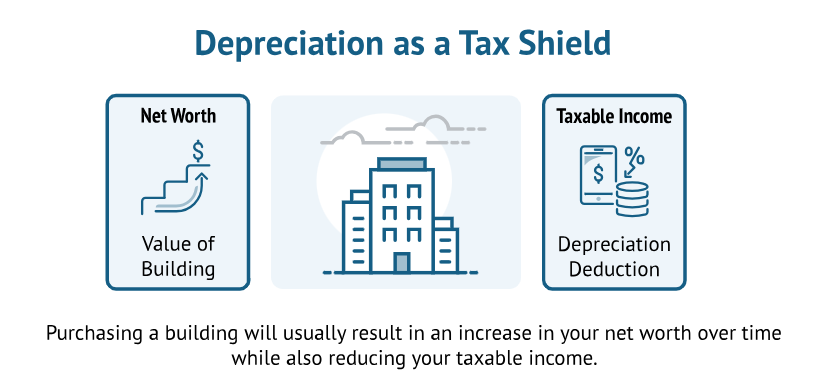

Own a building for your business:

Investing in a commercial building instead of using a third party to rent space is one tax-saving tactic for small businesses. You can gain several advantages by buying a building to house your business. First, you can write off building expenses like mortgage interest and property taxes to reduce your taxable income. The building’s value is also likely to rise over time, offering the possibility of long-term appreciation. You can navigate the difficulties and ascertain the viability of this strategy for your company by seeking the advice of a tax expert.

IMAGE CREDITS: Fit Small Business

Plan for Estimated Taxes:

Preparing for estimated taxes is one of the most crucial aspects of small business tax planning. You can avoid potential underpayment penalties and stay on top of your tax obligations by estimating and paying your quarterly taxes on time. You can determine how much money you should set aside for tax payments by accurately projecting your income and expense, guaranteeing you will have enough funds available as the due dates draw near. You can make accurate estimates and modify your quarterly tax payments as necessary by regularly reviewing your financial statements and seeking advice from a tax expert. Planning for estimated taxes helps you comply with tax laws and promotes financial stability.

With over two decades of experience in the field, Citi Accounts are experts in all things related to tax, and you can entrust your tax planning with Citi Accounts.

Stay Compliant with Tax Deadlines:

Staying compliant with tax deadlines is a crucial aspect of responsible Tax planning strategies for startups. To avoid penalties and interest charges, be aware of tax filing and payment due dates for federal, state, and local taxes. Learn about these deadlines, set up reminders, or use tax software that keeps you organised and on track to ensure timely compliance. Late filing or payment can result in unnecessary costs for your startup and possible financial repercussions. You can protect your startup’s financial stability and stay out of trouble by prioritising tax deadlines and maintaining a proactive approach to tax compliance.

Stay Updated on Tax Regulations and Seek Professional Guidance:

For small businesses to maintain compliance and minimise taxes for small businesses, staying up to date on tax regulations is essential. Since tax laws and regulations are constantly evolving you must be aware of any modifications that may impact your operations.

Engaging a qualified tax professional who specialises in tax planning for small businesses, can be invaluable in this regard. You can receive expert advice from a tax professional, ensuring you know all applicable deductions, credits, and compliance requirements. They can assist you in navigating the complex tax landscape, identifying potential tax-saving opportunities, and ensuring your company set-up is tax-effective. By leveraging their knowledge and experience, you can optimise your tax position and minimise liability.

Unlock the power of proactive tax planning to supercharge your small business’s financial success! Say goodbye to excessive tax burdens and hello to maximum savings. You’ll be unstoppable with a keen understanding of your business structure, clever deductions, strategic expense planning, and up-to-date knowledge of tax regulations. Don’t go it alone—team up with a seasoned tax advisor who’ll customise your strategy for optimum results. Together, you’ll conquer taxes, boost your bottom line, and pave the way to a prosperous future for your small business. Get ready to embrace the rewards of proactive tax planning and take your business to new heights!

To successfully navigate the complex tax landscape, keep in mind that staying on top of tax regulations and seeking the advice of a qualified tax professional is essential. With their assistance, you can make wise decisions for the financial success of your small business, ensure compliance, and locate tax-saving opportunities. We at Citi Accounts fulfil all these requirements and with over 2 decades of experience we can be your reliable partners when it comes to accountancy and all things taxes. Book a free consultation today!

Let us be your dependable partner as you maximise your tax savings and grow your small business!

Our Offices

- GNBC, 82 Great North Road, Hatfield, AL9 5BL

- Kemp House, 152-160 City Road, EC1V 2NV

- 133 High Street, Barkingside, Essex, IG6 2AJ

Contact

Please contact us on 020 3051 8444 or by email at info@citiaccounts.co.uk